- 07 Jan 2025

- 1 Minute to read

- Print

Accessing Tax Documents

- Updated on 07 Jan 2025

- 1 Minute to read

- Print

Early in 2025, you will have access your 2025 Tax Tables and 2024 W-2/1099 forms. Access them for free if you are on a monthly subscription for Procare or have an active annual maintenance plan.

Please note that tax tables are specific to each state and are updated in Procare as new versions are released by the states, which happens at different times throughout the year.

If you are a Desktop Package Solution customer, you do not need an activation code to access the Tax Tables. For those using a locally hosted version of Desktop with an active annual maintenance subscription, the updated tax tables will be automatically included and no activation code is required.

For help with annual maintenance subscriptions, please contact your account manager at clientservices@procaresoftware.com

Tax Tables for the New Year

View the Tax Tables for the New Year article if you've previously downloaded tax tables and now need updated tax formulas for the new year. Payroll tax tables include formulas for federal income tax, FICA – Social Security, FICA – Medicare, and state income tax tables.

W-2 Software

Learn how to download and and use the optional W-2 software compatible with Procare’s Payroll module. Learn More

Additional Information

Let Procare guide you through end-of-year tax preparation and setup with helpful articles, FAQs and videos. See: Be Ready for Tax Season

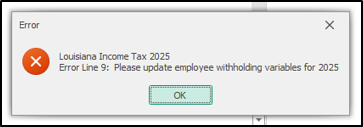

Iowa and Louisiana have transitioned from a tiered tax system to a flat rate based on filing status. To ensure accurate employee withholding, these changes require updating the employee withholding box.

Instructions for updating can be found here: Employee Withholding Update. Failure to update these values will result in the below error message, indicating that the withholding box needs updating.