- 19 Sep 2024

- 1 Minute to read

- Print

End of Year Topics

- Updated on 19 Sep 2024

- 1 Minute to read

- Print

End-of-Year

Let Procare guide you through the end of year tax preparation and setup with helpful articles, FAQs and videos.

How do I print or email End-of-Year Statements to all my families?

How do I write off bad debt?

May I add days the center is closed to my calendar for the new year?

How do I add paid holidays to all staff at once?

How do I change the Payroll Year?

How do I zero out vacation so it does not carry forward to next year?

What changed about W4s for 2020?

When are changes to tax tables available in Procare?

Does Procare update FUTA or SUTA (unemployment taxes)?

Electronic Filing: Does Procare allow me to e-file W2s?

How do I print W2s separately for each location?

How do I set up Vendor Tracking for 1099s?

How do I calculate beginning balances for the New Year?

Can I show a housing allowance on W2s?

Yes. You may wish the housing allowance to appear in a specific box on the W2, for example the box for “other”. If you are using Procare W2 / 1099 Software you can manually edit W2s for that person as needed. Contact your tax adviser or the IRS to determine how the information should be reported.

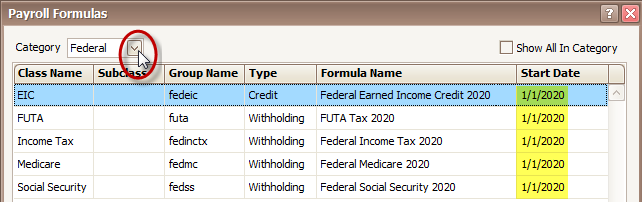

How can I tell if I have the most current tax tables?

From the Procare Home screen, go to Configuration > System > Accounting Management > Payroll > dbl-click Payroll Formulas. At the Payroll Formulas screen, choose either the Federal or State category (top left). On the right-hand side of the screen you’ll see a Start Date which indicates the effective date. In most cases this will be January of the current year. Mid-year changes will show a date after January 1st.

How do I order Tax Tables for the New Year?

Tax Tables are no longer purchased separately and are part of the Procare Annual Maintenance bundle. Please contact your Account Manager at clientservices@procaresoftware.com or call (800) 338-3884 and press 4