- 07 Jan 2025

- 2 Minutes to read

- Print

Tax Tables for the New Year

- Updated on 07 Jan 2025

- 2 Minutes to read

- Print

Please note that tax tables are specific to each state and are updated in Procare as new versions are released by the states, which happens at different times throughout the year.

If you are a Desktop Package Solution customer, you do not need an activation code to access the Tax Tables. For those using a locally hosted version of Desktop with an active annual maintenance subscription, the updated tax tables will be automatically included and no activation code is required.

For help with annual maintenance subscriptions, please contact your account manager at clientservices@procaresoftware.com

This article is intended for persons who have previously downloaded tax tables and now need updated tax formulas for the new year. Payroll tax tables include formulas for federal income tax, FICA – Social Security, FICA – Medicare, and state income tax tables. You must manually update FUTA & SUTA rates separately.

Download New Tax Tables

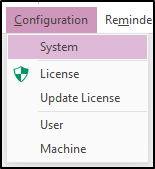

- From the Procare Home screen click Configuration > System.

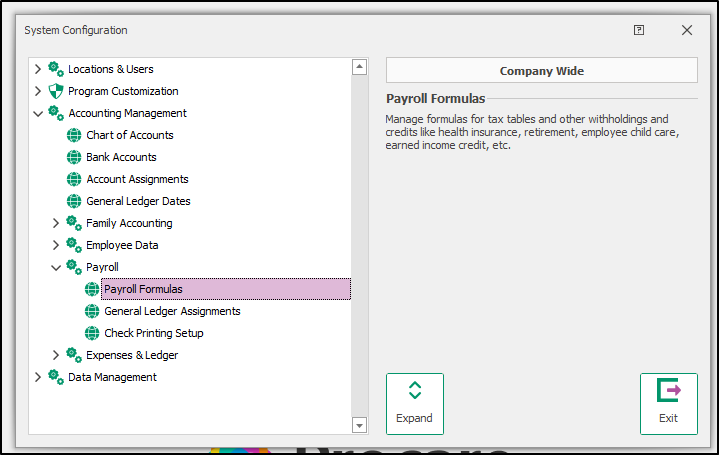

- Go to Accounting Management > Payroll > double-click Payroll Formulas.

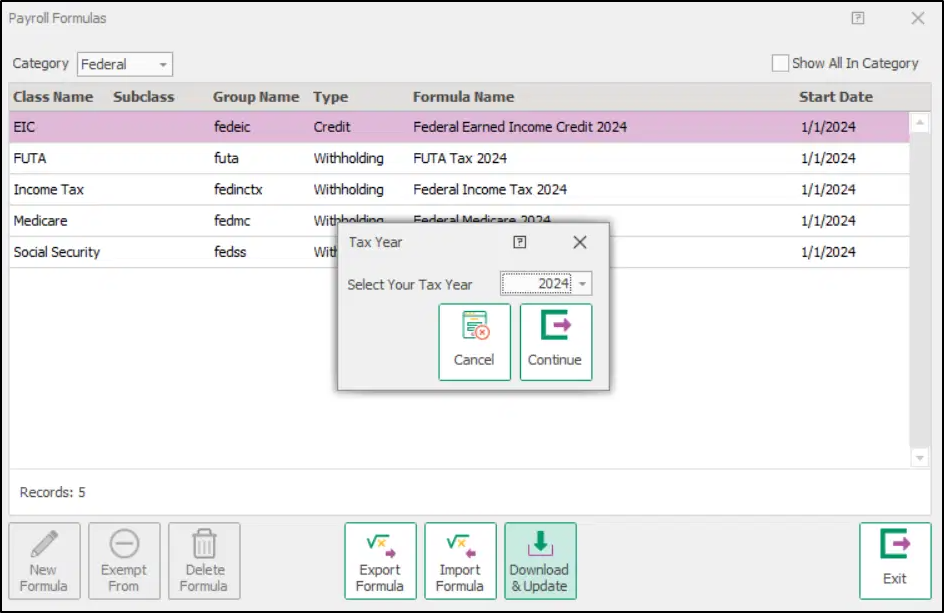

- Click Download & Update at the Payroll Formulas screen (bottom center).

- Choose a year for which you wish to Import Tax Tables, then click Continue.

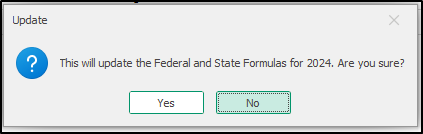

- Confirm that you wish to install tax tables for the selected year.

Your tax tables are now up-to-date.

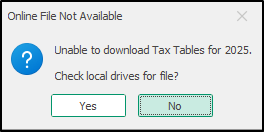

Can’t Download Tables?

In some cases you may get a message saying: Online File Not Available or Unable to Download. This can happen if you are not online, or if the tax tables are not available on the Procare site. For example, tax tables for the new year are typically not available until early January.

Generally you’ll answer “No” to the message. Searching local drives is only useful in very specific circumstances.

Please reach out to customer support if you are unable to update your tax tables.

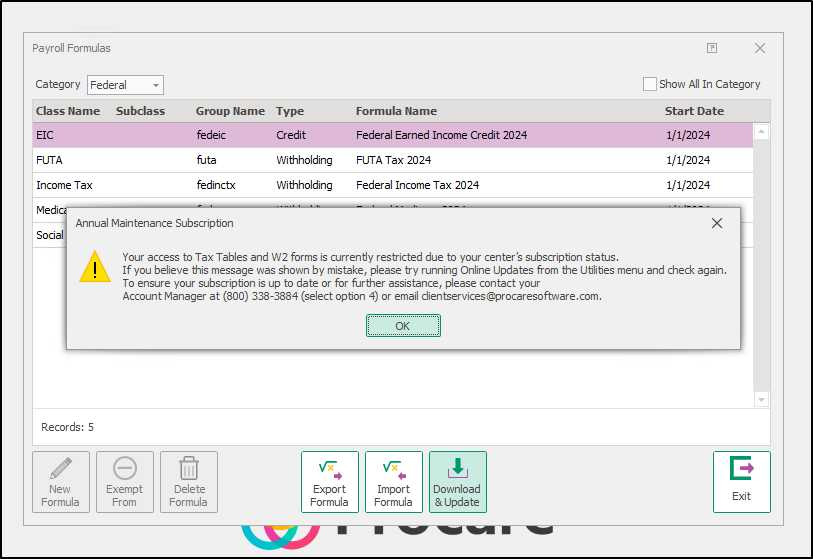

Annual Maintenance Subscription

For local customers with an active annual maintenance plan, tax tables are included as part of your package. If your plan is inactive, you will receive the following message.

Please attempt an online update before reaching out to your account manager. Sometimes the system may be in maintenance mode, and syncing with the server via the online update can help register your active maintenance status.

To do this, go to Procare Home > Utilities > Check for Online Update.

If you have followed the above steps and are still unable to access the updated tax tables, please contact your account manager for assistance with annual maintenance subscriptions at clientservices@procaresoftware.com.

Additional Information

The following information is effective January 7th 2025 and will be updated accordingly.

Updated for 2025

- Arkansas

- California

- Colorado

- Connecticut

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- New Mexico

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Rhode Island

- South Carolina

- Utah

- Vermont

- Virginia

- West Virginia

No State Income Tax

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

No updates or not yet released

- Alabama

- Arizona

- Delaware

- District of Columbia

- Maryland

- New Jersey

- Pennsylvania

- Wisconsin

Iowa and Louisiana have transitioned from a tiered tax system to a flat rate based on filing status. To ensure accurate employee withholding, these changes require updating the employee withholding box for each employee.

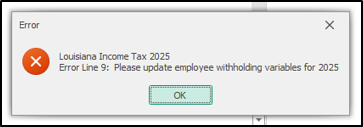

Instructions for updating can be found here: Employee Withholding Update. Failure to update these values will result in the below error message, indicating that the withholding box needs updating.